The Truth About Annuities Retirement

Annuities get a bad rap, but some are the right solution for retirement savings dilemmas. from TheStreet, Jan. 8, 2019by Robert Powell We know what you’re thinking. Annuities! Run away! But […]

Annuities get a bad rap, but some are the right solution for retirement savings dilemmas. from TheStreet, Jan. 8, 2019by Robert Powell We know what you’re thinking. Annuities! Run away! But […]

Steve Vernon, FSA, Research ScholarStanford Center on Longevity When replacing defined benefit plans with defined contribution plans, it may not have been a good idea to ask ordinary workers to […]

April 2021 – Meghan Eddy (Executive Vice President, National Accounts) adds the following to her community activities: Women of the West (Co-Founder) – This is a nonpartisan group that supports female candidates running to […]

January 2020 – As part of our national sales meeting, our staff rolled up our sleeves to support the work of Ronald McDonald House Charities of Central Indiana. Divided into three […]

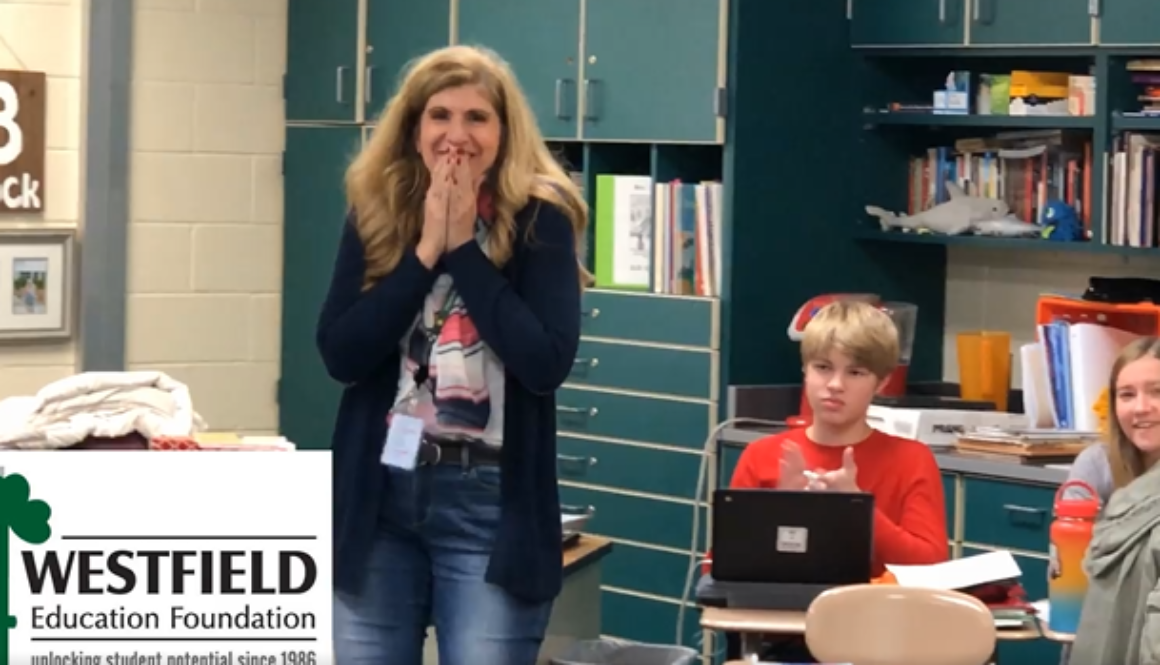

November 2019 – Teresa Gift (Director of Human Resources), a member of the Westfield Education Foundation Teacher Grant Committee, helped to award several teacher grants. Click on the images below to […]

August 2019 – InSource staff volunteered to furnish an apartment at Coburn Place Safe Haven

August 2019 – InSource contributed to the El Paso Shooting Victims’ Fund and the Dayton Oregon District Tragedy Fund. We hope you’ll consider helping out the families of those affected.

June 2019 – InSource attended Coburn Place’s Blue & Gold fundraising breakfast at Bankers Life Fieldhouse. (pictured below, left to right: Teresa Gift, Jim Nickens, and Christine Faucett).

InSource is a proud sponsor of TOPSoccer, a free program for athletes with physical and intellectual challenges. During the summer of 2018, InSource donated $2,500 to support the work of […]

On July 28, 2018, President Jim Nickens helped host a collaborative fundraiser with Indy Eleven Professional Soccer and 3v3 Live National Soccer Tour. Proceeds from the event benefited Ronald McDonald […]

Since 2012, InSource employees have been active volunteers at Ronald McDonald House Charities of Central Indiana, serving meals to families.